Pension Fund Earns $125 Million in July, Outperforms Benchmark

August 23, 2018: Rhode Island's pension fund continued to deliver strong performance under Treasurer Magaziner's Back to Basics investment strategy earning $125 million in July. That 1.51 percent return on the month finished ahead of the fund's benchmark which returned 1.31 percent. The positive performance was driven by the investments in the global stock market - mostly low fee index funds designed to provide long-term growth.

"Public servants who spend their careers deserve to know that their pensions will be there for them in retirement and taxpayers deserve to have their public pension systems managed responsibly," said General Treasurer Seth Magaziner. "My Back to Basics investment strategy is performing well and the health of the system continues to improve."

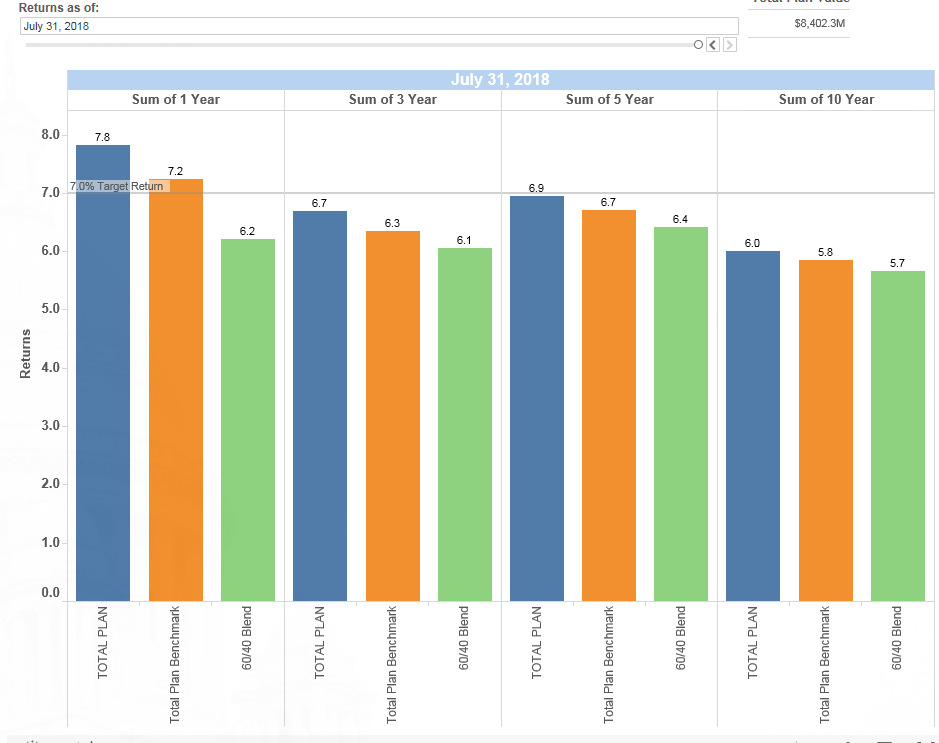

In the 3-year period ending July 31, 2018 the fund also outperformed its benchmarks; earning an annualized return of 6.68 percent versus the plan benchmark return of 6.34 percent, as well as a traditional 60 percent stock/40 percent bonds portfolio, which would have earned 6.06 over the same period.

Over a 5-year period, the fund earned an annualized return of 6.95 percent, outperforming the internal benchmark return of 6.71 percent and a 60/40 benchmark, which posted 6.41 percent.

Detailed information about the $8.4 billion fund, including the Back to Basics investment strategy, performance, and detailed information about its managers are published online as part of Treasurer Magaziner's "Transparent Treasury" initiative at investments.treasury.ri.gov.